Inherited House Fresno – All You Need To Know!

Fresno is an excellent location to have a property. It has a strong real estate market, a diverse and lively culture. However, owning a house in Fresno also means you’ll need to manage property taxes, repairs, dealing with legal matters, etc.

Inherited House Fresno refers to a property passed down to a family member or heir after the original owner’s passing. But it also has many responsibilities that you have to fulfill, like legal matters, taxes, and the decision of whether to sell it or not.

This article will explain everything about inherited house Fresno and what to do with your inherited property: keep it, sell it, rent it out, and many more.

Why Fresno Is A Great Place To Own A House? – For Those Who Don’t Know!

Fresno, California, the state’s fifth-largest city and the largest inland city, situated in the fertile San Joaquin Valley, is known for its diverse agricultural production.

Fresno’s prime location also offers easy access to natural attractions like Yosemite National Park, Sequoia National Park, and Kings Canyon National Park, making it a desirable place to inherit a house.

You can discover further by exploring history, culture, and economy.

History And Culture:

Fresno has a diverse and lively culture rooted in its rich history and traditions. The city is a hub for various cultural experiences, including museums, theaters, festivals, and events highlighting its art, music, and cuisines of the city.

Additionally, Fresno’s strong economy offers a range of employment opportunities in sectors like education, healthcare, manufacturing, and technology.

Economy Of Fresno:

Fresno’s real estate market is thriving, marked by high demand and limited housing availability, increasing property prices and values.

According to Zillow’s data from November 2022, the median home value in Fresno reached $343,900, marking a 16.9% increase from the previous year.

Similarly, the median monthly rent stood at $1,750, indicating an 11.1% rise from the previous year. These trends suggest that owning a house in Fresno can yield a profitable return on investment.

What I Have To Do First After Inherited A Property In Fresno, California? – Beginner’s Guide!

1. Verify Your Ownership: Your first priority is to confirm your property ownership. This suggests checking the title to ensure that it has been correctly transferred to your name.

2. Secure the Property: To protect the property, change the locks, and implement any other required security measures. This helps safeguard the house and its contents.

3. Notify Relevant Parties: Inform all relevant parties about the change in ownership. This includes getting in touch with insurance companies, utility providers, and the local government to update them on the new ownership status of the property.

What Can I Do With My Inherited House In Fresno? – Your Next Step!

1. Move Into The Property:

Keeping the house you’ve inherited in Fresno can be the best choice if you plan to live in it or use it as a vacation retreat. This way, you can enjoy the advantages of being a homeowner, including building equity, having a stable place to call home, and the freedom to personalize your living space.

Additionally, keeping the inherited house allows you to preserve its sentimental value and pay tribute to the memory of your loved one.

Nonetheless, it’s important to recognize that maintaining your inherited Fresno property also brings about certain expenses and responsibilities. You’ll be responsible for covering property taxes, insurance, repairs, utilities, etc.

Furthermore, you may encounter legal matters linked to inheriting the property, such as issues related to probate, transferring the property title, dealing with inheritance taxes if they apply, and potentially sharing ownership with other heirs if they exist.

2. Rent Out The Property:

Renting your inherited Fresno house can provide passive income due to high rental demand. You’ll maintain ownership and equity while receiving rent. It may yield tax benefits, like depreciation deductions and long-term value appreciation.

However, it entails responsibilities:

- Finding and evaluating tenants (or using a property manager).

- Handling rent collection (or hiring an accountant).

- Managing property upkeep (or employing contractors).

- Complying with landlord-tenant laws (consider legal advice).

- Dealing with income tax on rent (tax professional help).

- Resolving issues like vacancies, evictions, damage, or legal disputes.

3. Sell The Property:

Selling your inherited house in Fresno can be a wise decision if you’re looking for a quick cash amount and prefer to avoid the complexities of property ownership and management.

The proceeds from the sale can be used to settle any debts or expenses tied to the inheritance or invested in other opportunities.

Additionally, there’s the potential advantage of not incurring capital gains tax if you sell the property within one year of inheriting it, thanks to the step-up tax basis rule.

However, selling your inherited Fresno house does present certain challenges and risks. These include preparing the property for sale, involving tasks like cleaning, making necessary repairs or improvements, and marketing it to attract potential buyers.

Moreover, you’ll have to handle closing costs, including commissions, address contingencies like inspections or appraisals, and negotiations regarding prices and terms.

Depending on factors such as the property’s condition, location, and the state of the real estate market, a quick and profitable sale may not always be guaranteed.

What Is Probate, And How Can I Avoid Probate When Inheriting A House In Fresno? –

Probate, a legal process for settling a deceased person’s estate. It can be expensive, time-consuming, and stressful for heirs.

If you’re inheriting a Fresno house, you may seek to avoid probate for a smoother property transfer. Here are a few methods to achieve that:

1. Joint Tenancy with Right of Survivorship:

If you and the deceased co-owned the house as joint tenants, the surviving owner automatically becomes the sole owner after the other’s passing.

This circumvents probate, sparing you the court process. However, it may not apply if the deceased was the sole owner or had other heirs with claims to the property.

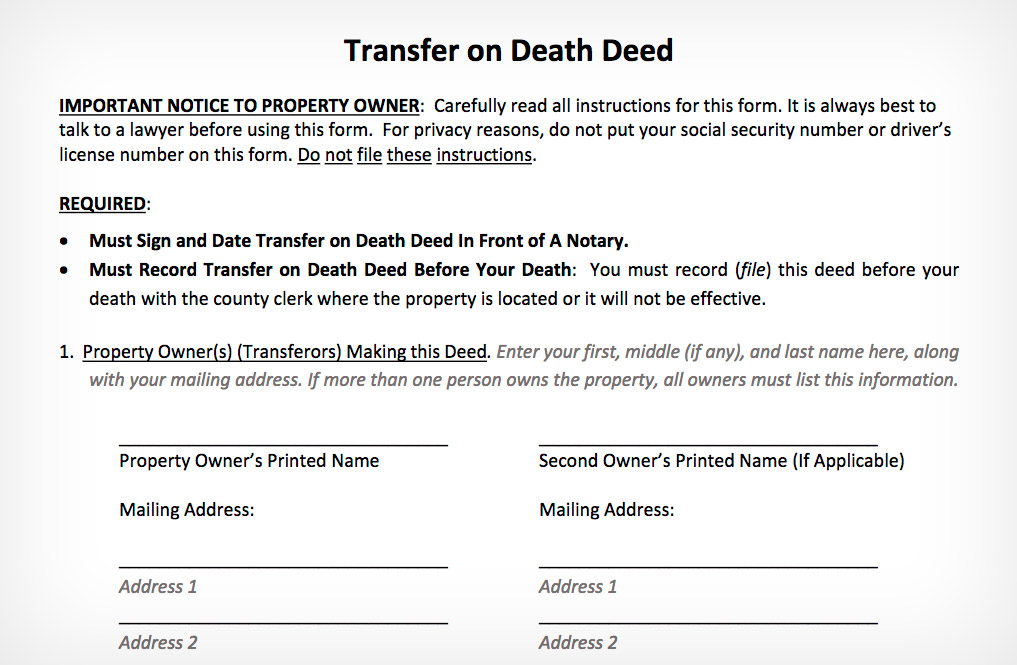

2. Transfer on Death Deed:

This specialized deed permits the property owner to name a beneficiary who will inherit the property upon death.

The beneficiary has no rights or responsibilities until the owner’s passing, and the transfer doesn’t go through probate.

While relatively straightforward and cost-effective, it might not be valid in all states or property types.

3. Living Trust:

This legal arrangement enables the property owner to transfer the property into a trust managed by a trustee for the beneficiaries’ benefit.

The owner retains property control during their lifetime, and upon their death, the trustee distributes the property per the trust’s terms.

This method avoids probate and offers more flexibility and protection for the property and heirs, although it may involve more complexity and cost during setup and maintenance.

Some Trusted Companies That Buy Houses In Fresno – Explore More Options!

- Houzeo.com:

Houzeo is America’s most advanced real estate marketplace. They offer the potential to receive up to 100% of your property’s value and attract buyers from all over California.

- John Medina Buys Houses:

Established by John and Yvette Medina in 2013 in Los Angeles, California, “John Medina Buys Houses” provides quick cash deals and fast closing options for your property.

- We Buy Houses:

We Buy Houses is a private service catering to real estate investors. They offer you the opportunity to sell your inherited house for cash, regardless of its condition.

How I Sold My House Quickly And Easily? – Step By Step Guide!

Let me share my experience of selling the inherited house in Fresno. It wasn’t a simple task. I had received the house from my uncle, but living in it wasn’t my plan. I wanted to sell it and utilize the funds for other purposes.

1. Hiring A Real Estate Agent:

This is the most common approach when selling a house. You enlist the services of a real estate agent who possesses expertise in the housing market. The agent assists with pricing, advertising, negotiations, and the sale process.

They also handle the paperwork and communicate with interested parties. However, hiring an agent involves paying a commission, which can significantly reduce the final sale profit.

2. Selling To A Cash Buyer:

I chose this method. I found a buyer who had the financial resources and was willing to purchase the house in its current condition. They weren’t concerned about the property’s appearance, location, or market demand.

They didn’t require inspections or checks; they simply made an offer, and I accepted it. The transaction was completed within a week, with no hassles or delays.

While this option saved me time, money, and stress since I didn’t need to invest in property improvements or handle various issues.

3. Selling Through An Online Platform:

This was a relatively new approach I came across. It’s a service that connects sellers with multiple interested buyers.

You only need to upload property information and photos, and you receive offers from various buyers within a day. You can select the best offer and finalize the deal in just two weeks.

This method offers more flexibility, convenience, and speed since you can avoid dealing with real estate agents, property repairs, or property showings.

However, using an online platform typically involves paying a fee, which may vary depending on the service and offer.

5 Things To Consider That You Must Know Before Inheriting Property In Fresno – Must Read It!

- Financial Responsibility: You’ll be responsible for any outstanding debts, property taxes, and potential association fees.

- Repairs and Updates: Older homes may require costly repairs. Get professional inspections and multiple repair estimates.

- Personal Belongings: Removing the previous owner’s belongings can be time-consuming but necessary to prevent further deterioration.

- Home Purchase Plans: Inheriting a property can affect your financial situation and mortgage eligibility.

- Tax Implications: The tax consequences depend on various factors, but generally, California does not impose state estate or inheritance taxes on real estate.

Frequently Asked Questions

1. Can I rent out an inherited property if I live out of state?

Yes, it’s possible, but it can be more difficult to handle from a distance. You might want to think about hiring a property management company to assist you in this situation.

2. What if there are multiple heirs, and we can’t agree on what to do with the property?

Seek professional advice from an attorney or mediator to help resolve any disputes and ensure a fair resolution.

3. Do I have to pay inheritance tax on an inherited house in Fresno?

No, in California you won’t be charged an inheritance tax or an estate tax. But there’s a possibility you might need to pay a federal estate tax if the total value of the entire estate, which includes the inherited house, is higher than a specific exemption amount, which was set at $11.7 million in 2021.

4. How long does it take to sell an inherited house in Fresno?

It almost takes 30 to 60 days just to sell a property in fresno. Hoevre, it also depends on several factors, like the condition and area of the house, the state of the market, the price that offers.

Conclude It:

Inheriting a house in Fresno can be both complex and emotionally charged. Nevertheless, by grasping the legal and financial aspects of your inheritance, you can make well-informed choices regarding the property’s future. Whether you opt to sell, rent, or live in the house, it’s vital to handle the situation thoughtfully.

Remember that each case is unique, and there is no one-size-fits-all solution. Take your time, seek professional advice, and make informed choices that align with your financial and personal goals.