Merchant Cash Advance Blursoft – Take A Closer Look!

Blursoft is a leading provider of MCAs. Merchant cash advances (MCAs) are becoming increasingly popular among small businesses as an alternative to traditional loans.

Merchant cash advances (MCAs) are unsecured funding options for professionals who need a specific amount of money but can’t qualify for a conventional loan. They’re good for small businesses because they’re flexible and have fewer requirements to apply than traditional loans.

In this article, we’ll examine Blursoft’s MCA program, discussing its advantages, potential drawbacks, and whether it’s the right choice for your business.

Mca Vs Business Loan – Understand The Basics!

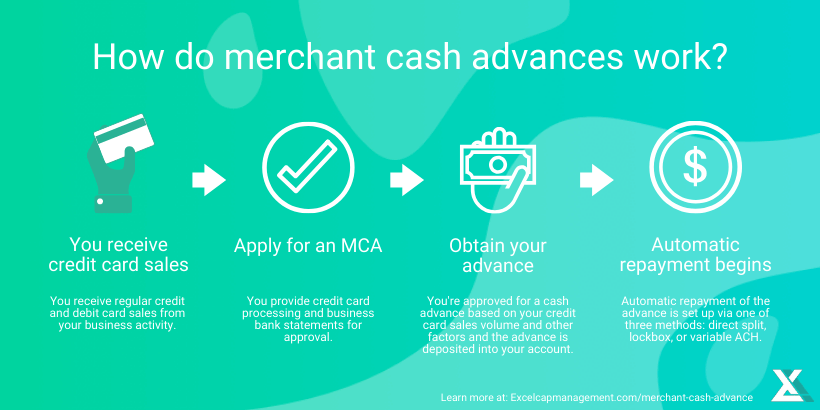

Created in the 1990s, business and merchant cash advances are alternative types of financing options and, technically speaking, are not considered traditional bank funding.

With small business financial merchant cash advance options, you receive a lump sum of money like with loans.

A business loan differs in how small business merchant cash advance is repaid. A business loan is paid back with monthly payments, whereas a business and merchant cash advance is paid back with your future credit card merchant account monthly, daily or weekly credit card sales.

You only owe something with a business and merchant cash advance once you generate sales. This flexibility can relieve small businesses from a lot of burden and stress.

A business and merchant cash advance sells future revenue (credit card sales). It is, therefore, not a business loan. That’s why getting funding from the banks is much easier and faster.

What Are the benefits of small businesses that use Merchant Cash Advance Blursoft? – have a look!

- Fast Access to Capital: Blursoft’s streamlined application and approval process ensures businesses can access funding swiftly, often within days. This is particularly advantageous for businesses facing urgent financial needs or unexpected expenses.

- No Collateral Requirement: Unlike traditional loans that may necessitate collateral, Blursoft’s MCA is unsecured, alleviating the burden on businesses to pledge assets as security. This especially benefits businesses needing more valuable assets or those hesitant to risk collateral.

- Flexible Repayment Structure: Blursoft’s repayment structure is based on a percentage of daily credit card sales, offering flexibility that aligns with the business’s cash flow. During low sales periods, repayment decreases, easing the financial strain on businesses.

- No Fixed Monthly Payments: Traditional loans typically entail fixed monthly payments, regardless of business performance. In contrast, Blursoft’s MCA adapts to fluctuations in sales volume, ensuring that businesses are not burdened with unmanageable payment obligations during lean periods.

- Simple Application Process: Blursoft simplifies the application process, requiring minimal documentation and credit checks. This makes funding accessible to businesses with less-than-perfect credit scores or limited financial history.

Here you go! While Blursoft’s merchant cash advance offers numerous benefits, businesses must consider the associated risks. So, let’s explore them!

How Do I Apply for a Business and Merchant Cash Advance (MCA)? – Full Guide!

Blursoft Capital, a merchant cash advance provider, offers funding ranging from $5,000 to $500,000 for up to two years. We have low rates starting at 1.2. Our small business merchant cash advances can be funded within 24 hours after approval.

To qualify for a small business MCA with Blursoft’s funding partners, companies need to meet these requirements for quick approval:

- Be in business for at least four months.

- Generate at least $10,000 in sales per month.

- Have a credit score of 500 or above.

You can apply through our online form if you meet these conditions. Fill it out, connect your company bank account, or contact us for assistance. A funding specialist will review your application and discuss your needs with you to find the best financing solution.

Once approved, you’ll receive the funds in just 24 hours. Join the many businesses that have benefited from our small business MCAs and apply now!

Some Potential Risks Related To Merchant Cash Advance Blursoft – Must Consider All Of These!

- Higher Cost of Capital: MCAs typically incur higher costs than traditional loans, as businesses effectively pay a premium for the convenience and accessibility of immediate Funding. The factor rate determines the total repayment amount and can result in a significant business expense.

- Impact on Cash Flow: While the flexible repayment structure of MCAs can be advantageous, businesses must assess the long-term impact on cash flow.

Depending on the terms of the agreement, a significant portion of daily credit card sales may be allocated towards repayment, potentially affecting liquidity.

- Potential for Debt Cycle: In some cases, businesses may become trapped in a cycle of debt if they rely too heavily on MCAs to cover recurring expenses.

The convenience of quick funding can mask underlying financial challenges, leading to a dependency on high-cost financing solutions.

- Lack of Regulation: Unlike traditional lending institutions, the MCA industry is less regulated, exposing businesses to potential predatory practices or deceptive terms. Companies must conduct thorough due diligence and review the terms and conditions before agreeing with a provider like Blursoft.

Is Blursoft’s Merchant Cash Advance Right For Your Business? – Navigate To Your Future!

While Blursoft’s merchant cash advance provides easy access and flexibility, it may not suit every business. Before choosing an MCA, businesses should consider their financial needs, look at other funding options, and consider how it might affect their cash flow and profits in the long run.

Blursoft’s option could work well for businesses needing money fast, especially if their income changes yearly. But, it’s important to consider the costs and risks before deciding if it’s the right choice for the business’s financial goals.

Frequently Asked Questions:

1. Can businesses with less-than-perfect credit scores apply for Blursoft’s MCA?

Yes, Blursoft’s MCA application process considers various factors beyond credit scores. While a credit score of 500 or above is preferred, other aspects of the business’s financial health are also considered during the approval process.

2. What is the typical repayment period for Blursoft’s merchant cash advance (MCA) offerings?

Typically, Blursoft’s MCAs offer repayment periods of up to two years, giving businesses a reasonable timeframe to pay back the advance.

3. Does Blursoft require businesses to provide collateral for their merchant cash advance?

No, Blursoft’s MCA program is unsecured, meaning businesses do not need to pledge collateral to secure funding. This alleviates the need for businesses to risk valuable assets and provides greater flexibility in accessing capital.

Final words:

Blursoft’s merchant cash advance offers fast and flexible funding, with benefits like quick access to capital and a simplified application process. However, businesses should consider associated risks, such as higher costs and potential impacts on cash flow.

Read More: